The Elite Financial Centre should be a goal for all the aspiring entrepreneurs who want to set up their business in the field of Investments & Financial Planning. It is an opportunity to start an endeavor towards maximizing your revenue from your own existing network of people. The entrepreneur gets a chance to lead certified financial planners and investment advisors in the field of personal finance. They must harbor the vision of making people’s money work for them. Always remember that, if your clients make money and receive the prompt service then they will never detach their relationship with you. And, therein lays your success.

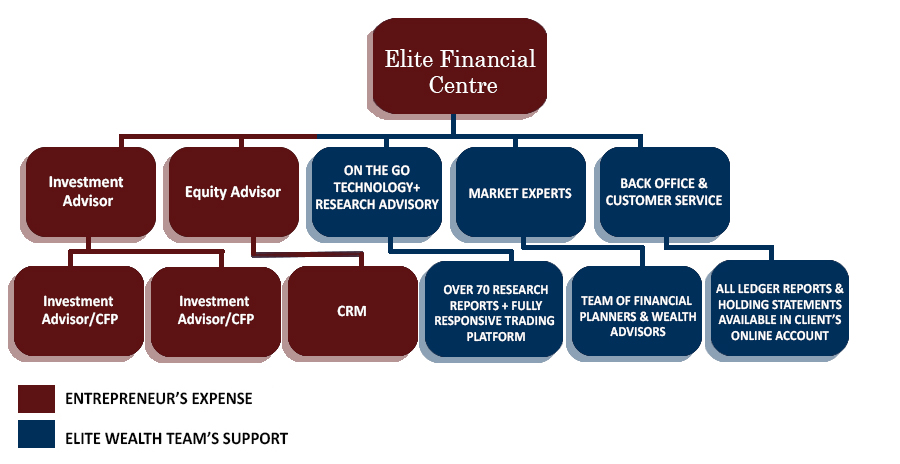

The model that we follow at the Elite Financial Centre looks like the following:

Your Eligibility Criteria: –

- The applicant is not less than 21 years of age

- The applicant has not been convicted of any offence involving fraud or dishonesty

Applicant must have approved commercial space of minimum 300 Sq. Ft. at an upcoming and well connected location.

- Should have a 12 passing certificate (minimum requirement by SEBI to be a registered sub-broker)

- In addition to the INR 500,000 as a security deposit the applicant must have sufficient amount of working capital till the time the business starts generating sales. The Working Capital requirement will be around 3-5.5 L, as per the requirements of the Associates.

- Should have required infrastructure in the office to run the business (i.e. Two Computers, Online UPS min. 2KVA, Voice Recording System, Scanner & Printer and Broad band Internet connection)

Have to do registration with SEBI as a sub broker / AP by paying appropriate fees as applicable.

The Business Associates will be required to Deposit the security amount which will be refunded to him/her in case he/she decides to wind up the business.

We have 6 segments for which the Business Associates has to deposit Rs 5,00,000/-. The segments are NSE, BSE, NSE F&O, MCX, NCDEX & NSECDs

In order to become Registered Associate on the Exchange the Business Associates has to register himself/herself along with the payment of registration fees and Certifications:

| SEGMENT | REGISTRATION AMOUNT | Payment Mode |

| NSE Cash | Rs. 2300/- | DD/ Cheque in Favour of Elite Wealth Ltd. |

| BSE Cash | Rs. 2300/- | DD/ Cheque in Favour of Elite Wealth Ltd. |

| Future & Options | Rs. 2300/- | DD/ Cheque in Favour of Elite Wealth Ltd. |

| NSE Currency | Rs. 2300/- | DD/ Cheque in Favour of Elite Wealth Ltd. |

| MCX | Rs. 1150/- | DD/ Cheque in Favour of Elite Comtrade Pvt Ltd |

| NCDEX | Rs. 1150/- | DD/ Cheque in Favour of Elite Comtrade Pvt Ltd |

| Distributor of Mutual Funds | NIL | NA |

| Distributor of Debt Sec. | NIL | NA |

DOCUMENTS REQUIRED

- Pan card

- Aadhar Card

- Educational proof (minimum intermediate)

- Residential address proof

- Office address proof(electricity bill, phone bill-BSNL or MTNL, bank statement)

- Four photographs

- CA reference letter

- Name affidavit in case of any kind of mismatch in name on a Rs 10 stamp paper

Note: Above documents should be attested from Notary or CA.

Product Mix

The greatest advantage of this model is that the Associates need not devote any resource developing a product line or pricing plans. Elite Wealth Ltd. has carried out detailed market analysis before choosing its pricing plans and developing its product line. The products on offer are the following:

Broking

Broking

- Across all segments: Equity / Derivatives / Currency / Commodity

Distribution of Mutual Funds

Distribution of Mutual Funds

- Investors benefit from an online platform to transact and view their holdings

- provide MF consultancy and portfolio restructuring

Distribution of Debt Securities

Distribution of Debt Securities

- We offer a variety of investments with different liquidities and tax treatments, that are better investments as compared to regular Fixed Deposits

Financial Planning

Financial Planning

- We Associates the client in taking his steps towards his financial wellness and completion of financial goals